BALANCE SHEET EXAMPLE

Introduction

“Why are female accountants the best lovers? Because they’re like a ‘balance sheet’. If it does not reconcile, it does not’ but if it does, it agrees in all positions” Haha!

Unlike the popular attitude expressed with adding numbers which require even more attention when dealing with finance, understanding the balance sheet is as simple as the joke above; your entries must be balanced.

A balance sheet is the financial summary of an organization which reveals its financial position. It includes values/resources owned by the owner (Assets), the organization’s debts/obligations (liability) and the net worth of that organization, which is the difference between assets and liabilities (Equity). It is one of three(3) major financial statements:

- Income statement

- Cash flow statement

- Balance sheet

Income statement– a financial report showing the company’s profit and loss over time. The profit and loss are revised as the difference between its revenues and all expenses.

Cash Flow statement– This financial statement reveals the inflow and outflow of cash and its equivalent from current and completed operations. It reveals the weakness and strength of an organization by stating its liquidity position and its financial strength to fund a project or consider debt.

Although the balance sheet is a financial summary, It does not and should not contain all financial information; in fact, it is impossible. It has its area of application and function, sharing such tasks of financial health evaluation with the income statement and cash flow statement, hence there are contents to be found on a balance sheet and what should not be seen.

Contents to be seen on a balance sheet

It should interest you that no matter how much information a balance sheet contains, it is split into just two sections- the assets and the liabilities, with a lower addition of the shareholders’ equity. That way, it can create a clear demarcation of what is owned from what is owed. Note that the balance sheet should list assets in order of their liquidity- their easy cash conversions.

Recommended: Example of a cover letter 2020

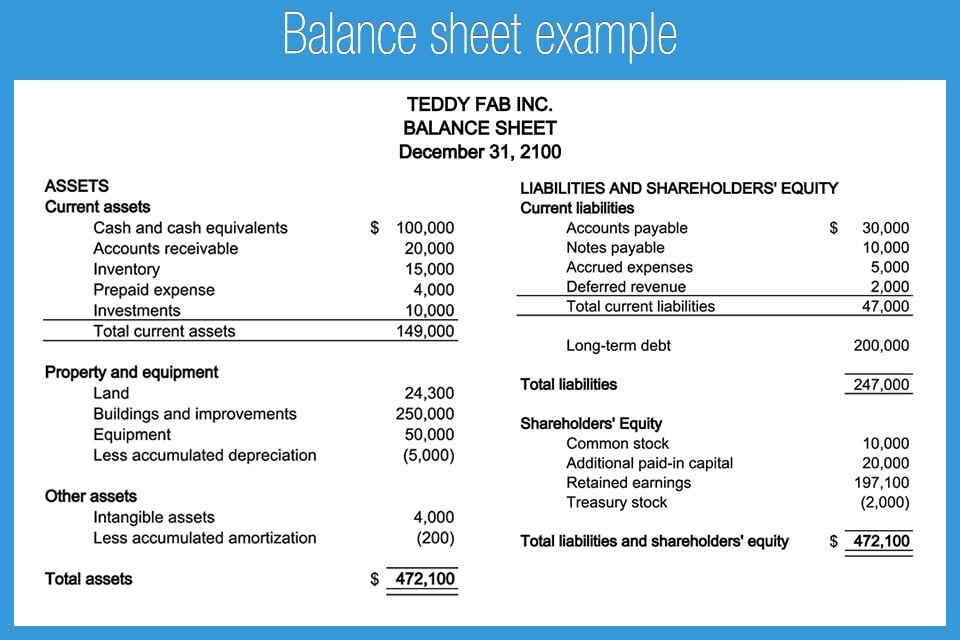

Fig: balance sheet example

The assets are divided into

- Current Assets: These are those assets having the possibility to be sold, exhausted or consumed within the operating fiscal year. It reveals the Monetary value and cash conversions of a business.

Current assets are categorized into:

- Cash and cash equivalents are the most liquid assets; they can be converted to cash almost immediately.

- Accounts Receivable: ‘receivable’ refers to pending payment. This is payment yet to be received by the company from clients for products or services purchased on credit. On record, cash is debited, and accounts receivable is credited.

- Marketable Securities: these assets are easily converted to cash. They are mostly traded on a public stock exchange or public bond exchanges; money market instruments and Treasury bills belong to this category as others.

- Inventory: this is the record of goods or raw materials present for sale.

- Prepaid Expenses: these are established priorities that have been paid for in advance, like pre-ordering goods or services, prepaid office rent, insurance, etc.

- Long-Term Assets: these are investments made by the organization with interests of benefits in the long run and cannot be liquidated within a year.

Also Read: Example of Tailgating as a Social Engineering cyber attack

They can be categorized into:

- Long-term Securities

- Fixed assets include physical property like buildings, machinery and equipment, etc.

- Intangible, nonphysical assets like copyrights, franchise agreements, patents, brand equity, goodwill, intellectual property, trademarks, etc.

LIABILITIES

This fragment contains debt and recurring expenses. It is Categorized Into

- Current liabilities include payroll, interest payments, taxes, rent, utilities, etc.

- Long-term liabilities include deferred income taxes, long-term loans, etc.

Shareholders Equity

This refers to the Monetary returns of each shareholder of an organization, say its debts were cleared and all assets liquidated. It is the net assets of a company and calculated as:

Stakeholders Equity = Total Assets – Total Liabilities

Note:

Shareholders’ equity can be positive or negative, the former being that an organization has matching assets for its liabilities and the latter that its liabilities/debts are greater than its assets.

Shareholders’ equity has the following performing under it:

- Outstanding shares

- Treasury stock

- Retained earnings

- Additional paid-in capital

Importance of a Balance sheet

As per definition, a balance sheet presents a summary of the financial health of a company’s business which, of course, comes with revising the other two(2) financial statements, as earlier stated. The importance of a balance sheet lies in its ability to expose:

- Efficiency is seen in comparing the income statement to measure productivity.

- Leverage- pre-knowledge of leveraging power exposes impending financial risks.

- Liquidity- comparing assets to liabilities tells how much cash is readily available and can be spent.

BALANCE SHEET FORMAT AND EXAMPLE