Example of Cash Flow Statement

Table of Contents

WHAT IS A CASH FLOW STATEMENT?

A Cash flow statement is one of the three (3) major financial reports– income statement and balance sheet, which measures the financial strength of a company by summarizing the amount of cash or cash equivalent which enters or leaves the company within a given time period.

Importance of a cash flow statement

- Cash flow statement reveals a company’s liquidity and informs on operating Cash flow.

- With Cash flow statements, a company can predict future inflows and outs of cash.

- Keeping an updated Cash flow statement facilitates the acquisition of Loans or lines-of-credit.

- It records changes in assets, liabilities and equity.

Example of Cash Flow Statement -How is Cash Flow Calculated?

Since cash flow statement acts as the middleman between the income statement and balance sheet, you will need to have those other two available because differences in Revenue, expenses and credit transactions will be drawn from them to find the net income.

Components and methods of calculating a cash flow statement

Cash flow statement has three (3) major components:

- Cash from Operating Activities: This refers to the cash flow gotten from Operating the business. It reflects the incomes and interests made from a company’s products and services through sales, purchases and other expenses made by the company; basically, it does not include cash flows from investing activities (long-term investments) and financing activities also (all forms of debt and repayment, stock repurchases and dividends), it rather includes any cash flows from current assets and current Liabilities.

Example of Cash Flow Statement -Methods of operating Cash Flow

- Direct Method: this is regulated by Cash inflow and outflow from the company’s operations. This is achieved by summing up the results of each calculated cash flow component- cash receipts from customers, cash paid to employees and other operating Cash flow transactions. They operate on the double-entry accounting principle.

The following is an example of a cash flow calculation using the direct Method format.

Example: Prepare the cash flows from operating activities section of a cash flow statement by the direct method using the following information:

| December 31 | 2011 | 2010 |

| Accounts Receivable | $34,130 | $28,410 |

| Prepaid Rent | 20,000 | 25,000 |

| Prepaid Insurance | 6,800 | 6,000 |

| Inventory | 23,030 | 15,450 |

| Accounts Payable | 14,590 | 31,300 |

| Salaries Payable | 8,310 | 5,120 |

| Interest Payable | 700 | 360 |

| Income Tax Payable | 2,340 | 0 |

| Year Ended December 31 | 2011 | |

| Net Sales | 64,970 | |

| Salaries Expense | 8,610 | |

| Rent Expense | 5,000 | |

| Insurance Expense | 3,200 | |

| Interest Expense | 1,650 |

Solution

| Cash Flow from Operating Activities: | |

| Cash Receipts | |

| From Customers (1) | $59,250 |

| Cash Payments | |

| To Suppliers (2) | −24,290 |

| To Employees (3) | −5,420 |

| For Purchase of Prepaid Assets (4) | −4,000 |

| Interest (5) | −1,310 |

| Income Tax (6) | −0 |

| Net Cash Flow from Operating Activities | 24,230 |

Calculations

- Customers: 59,250

= 64,970 + 28,410 − 34,130 - Suppliers: 24,290

= 23,030 − 15,450 + 31,300 − 14,590 - Employees: 5,420

= 5,120 − 8,310 + 8,610 - Purchase of Prepaid Assets: 4,000

= 20,000 + 6,800 + 5,000 + 3,200 − 25,000 − 6,000 - Interest: 1,310

= 360 − 700 + 1,650 - Income Tax: 0

= 0 − 2,340 + 2,340

- Indirect Method: unlike the direct method which works in the double-entry accounting principle, the indirect method for calculating cash flow statement operates on the accrual accounting principle which requires you taking the company’s net income off its income statement because, in such principle, revenue is entered when it is earned not when it is received.

- Investing Activities: This refers to that section of a cash flow statement that deals with the inflow and out of cash spent or generated from investment activities like purchasing, security or buying and selling of assets on long-term profits. This is an operation towards long-term and future growth.

- Financing Activities: This refers to cash circulation between a business, its owners and its investors. It focuses on how capital can be raised and paid back to its investors.

Examples of financing activities are:

Issuing bonds (positive cash flow)

Sale of treasury stock (positive cash flow)

Loan from a financial institution (positive cash flow)

Repayment of existing loans (negative cash flow)

Cash from new stock issued (positive cash flow)

Payment of cash dividend to stockholders (negative cash flow)

Purchase of treasury stock (negative cash flow)

Repurchase of existing stock (negative cash flow)

Redemption of bonds (negative cash flow)

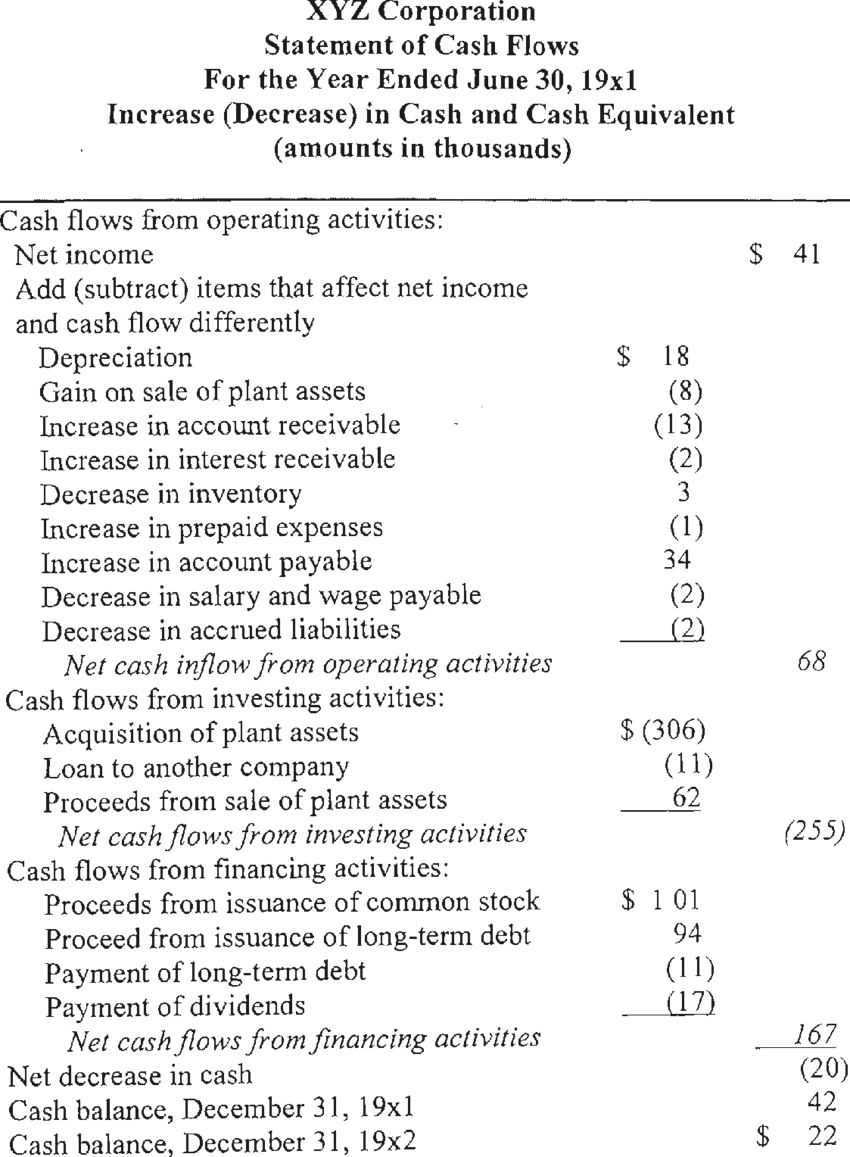

Example of a Cash flow statement

o you have any question on Example of Cash Flow Statement? You can use the comment box to leave us a message and we will respond as possible.